Member Success Story: How to Enjoy Your Finances

One employee thought it impossible to enjoy her financial status, that is, until she started working with MSA. Her journey started off like many employees: she found herself spending more than her income and unable to build savings.

One employee thought it impossible to enjoy her financial status, that is, until she started working with MSA. Her journey started off like many employees: she found herself spending more than her income and unable to build savings.

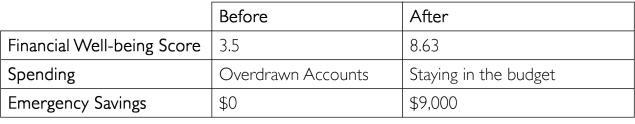

When Meredith entered the MSA program, she took a survey to measure her financial well-being and scored a dismal 3.5 out of 10, so she started working with her trusted Money Coach, Aaron, to learn the best practices for turning around her finances:

“[He] helped me set up categories for my expenses and determined percentages of my income that should be spent in each category. He helped me set up spending trackers and other trackers, so I could see where my money was going. Then he worked on changing my mindset, so I would think before shopping. Saving and planning for retirement has become more important than shopping. I still like to shop, but I do it more mindfully now.

Aaron helped me see where I could shave off expenses and necessary categories by lowering home owners insurance costs, reducing my personal expenses by doing more things for myself, by continuing to maintain and drive my old car instead of dreaming of a new Mercedes, and realizing that people who do drive Mercedes probably have credit card debt.”

Coach Aaron took an approach that included the psychology of money, so Meredith could change her behaviors and develop a healthy mindset around money that would lead to better financial stability and great financial wellness. She learned the importance of resisting costly temptations and saving instead.

More so than developing healthy financial habits, the member found that she could actually feel good about her financial situation: “Aaron has taught me that my money is me and that I can take more pride in saving than in things…. I now have several thousand dollars in savings in case of an emergency…. I now enjoy analyzing my finances; whereas, before Aaron I was afraid to look at it.” After working with her Coach, Meredith scored an 8 on her most recent financial wellness survey, and she is confident about where she’s headed financially.

Before she got the help she needed, her level of financial wellness was only 3.5. Unfortunately, most employees are still dealing with similar issues. Four out of five employees say they have financial stress.¹ Get relief and improve your financial well-being like Meredith by calling MSA today.

The Snapshot of Success

Financial Wellness Landscape Analysis: An Overview of the Need for Workplace-Based Financial Wellness Programs. ING Employee Benefits, 2013. PDF.

More Like This

A better marriage, affording a more expensive home, making room for vacations and grandbabies. What do these all have in common? Improving finances through the MSA Financial Wellness program! After just a few consultations with her MSA Money Coach, Trina reaped the benefits of a better budget and financial accountability. Here’s how… A Better Marriage […]

Rhianna had three weeks off work for knee surgery. She was in pain and frustrated, but it wasn’t just the recovery process she found exasperating. It was her finances. Rhianna needed accountability to help her deal with debt, overspending, a condo worth less than she owed, and wanting to buy a house. Through her employer, […]

When Renee initially came to MSA, she felt hopeless with managing her finances and starting her own business. “I didn’t have the support I needed to make this dream come true, and [it] actually derailed me on my path to self-sustaining entrepreneurship. I was influenced by the WRONG attitudes, and thank goodness I found the […]

When one thing after another goes wrong and your finances take a devastating hit, your MSA Money Coach can help you pick up the pieces and get back on track. See how Jack and his wife worked with their Money Coach, Patrick, to regain some financial stability. Financial Problems and Health Issues Financial challenges not […]